UAN - Know your UAN, UAN Passbook & UAN Services

What is UAN?

The Universal Account Number (UAN) is a unique 12-digit ID provided to employees contributing to the EPF. It helps consolidate multiple EPF accounts into one, making management easier. UAN also allows employees to track their PF balance, transfers, and claims online.

All Employee Provident Fund (EPF)-related services are now provided online as a result of the digitization of EPF operations. It is crucial to have a UAN in order to access EPF information and services.

Employees can easily and quickly complete a variety of EPF-related tasks online using the UAN, including EPF withdrawal, EPF transfer from one account to another, checking EPF account statement, getting access to EPF account passbook, and asking for a loan against EPF.

This is then authenticated by the Ministry of Labour and Employment, Government of India. This page will guide you through the process of getting a UAN, and activating the same.

- All EPF Member IDs under one UAN

- Easy transfer of EPF

- Simple EPF withdrawal process

- Easy access to EPF statement

How to get the UAN

The two methods that employees can use to find their UAN are mentioned below:

- Through the employer: Employees can find out their UAN by asking their employers. The UAN can also be found on the salary slip of the employees as well.

- By using the Member ID on the UAN portal: In case employees are unable to get the UAN from the employer, they can use the UAN portal to get their UAN.

- The below-mentioned procedure must be followed for employees to get the UAN on the portal:

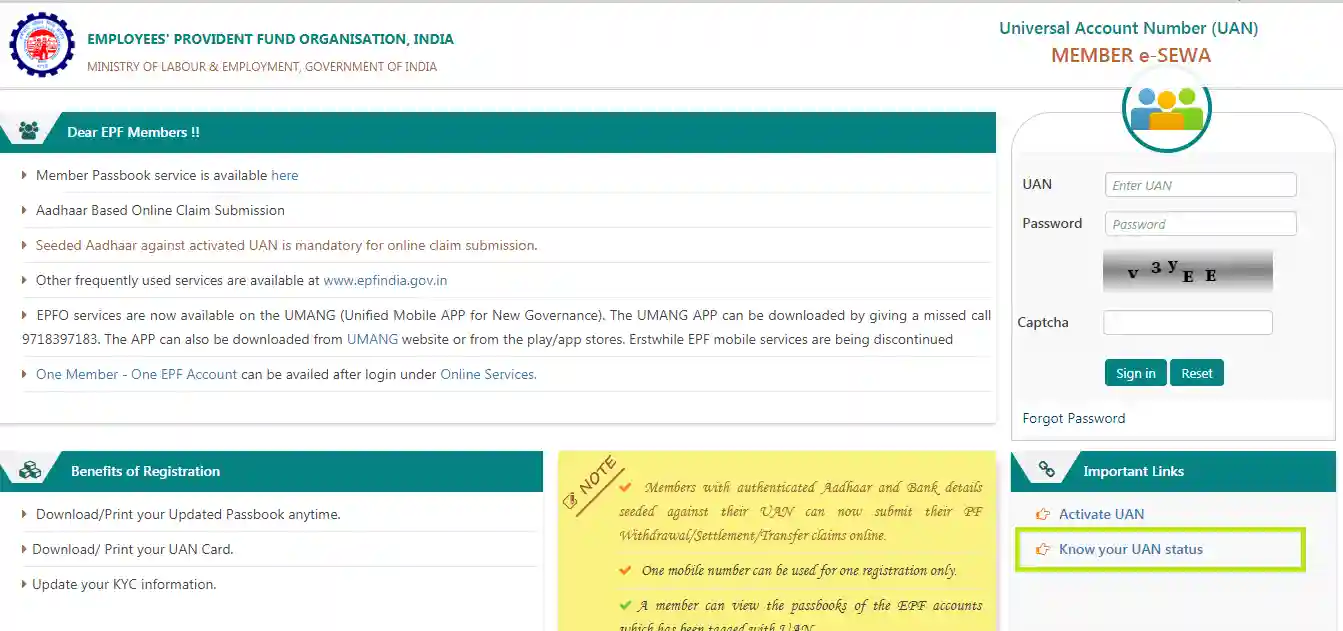

Step 1: The first step would be to visit the UAN portal (https://unifiedportal-mem.epfindia.gov.in/memberinterface/).

Step 2: Next, the member must click on 'Know Your UAN Status'. This can be found on the right-hand side of the page.

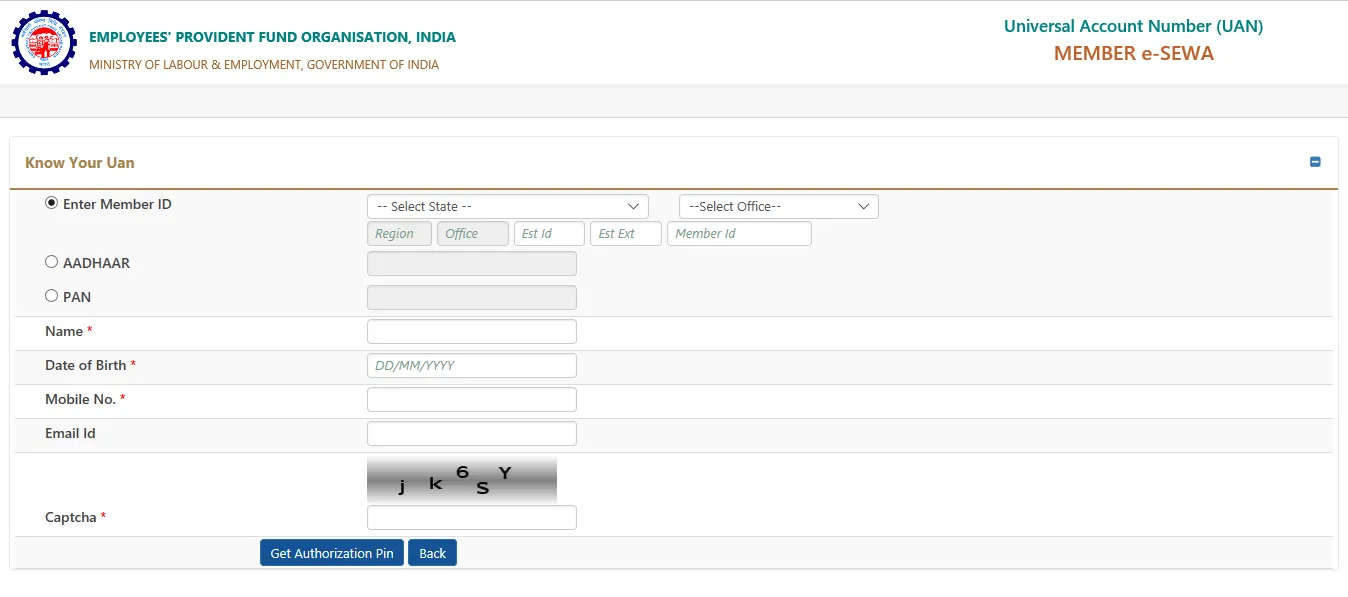

- Step 3: On the next page, the employee must enter all the details required such as the state and EPFO office, name, date of birth, and captcha.

- Step 4: After entering all the above details, the member must click on 'Get Authorization Pin'.

- Step 5: The member will receive the PIN on the registered mobile number. The next step would be to click on 'Validate OTP and get UAN' after entering the PIN.

- Step 6: The member will receive the UAN on his/her registered mobile number.

UAN Activation

Members must first activate their UAN in order to use the EPFO portal's full range of benefits. The following is the procedure involved in activating the UAN:

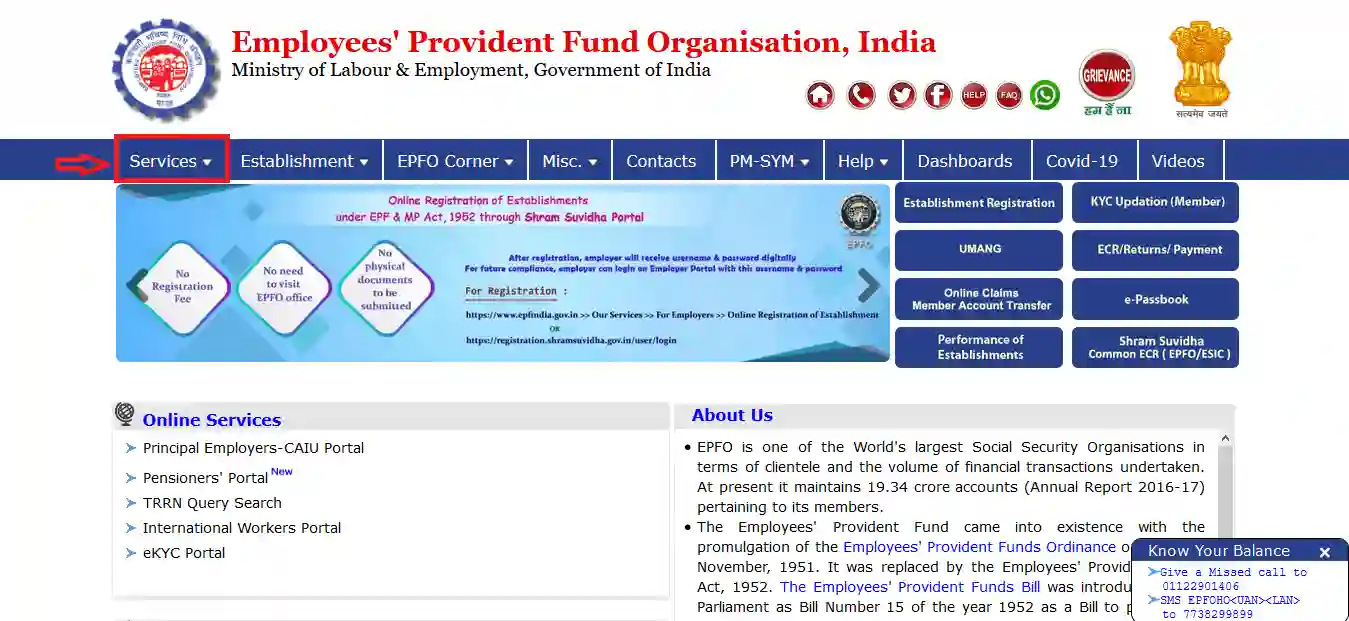

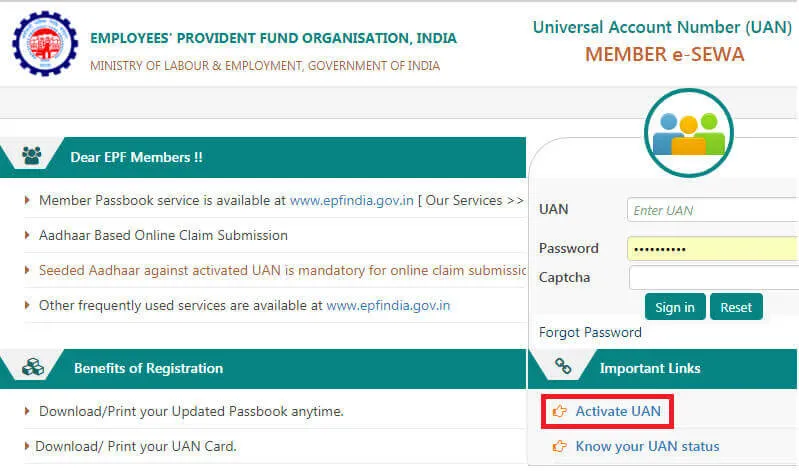

- Step 1: Initially, the individual must visit the EPFO portal (https://www.epfindia.gov.in/site_en/).

- Step 2: Next, the individual must click on 'For Employees' which can be found under the 'Our Services' tab.

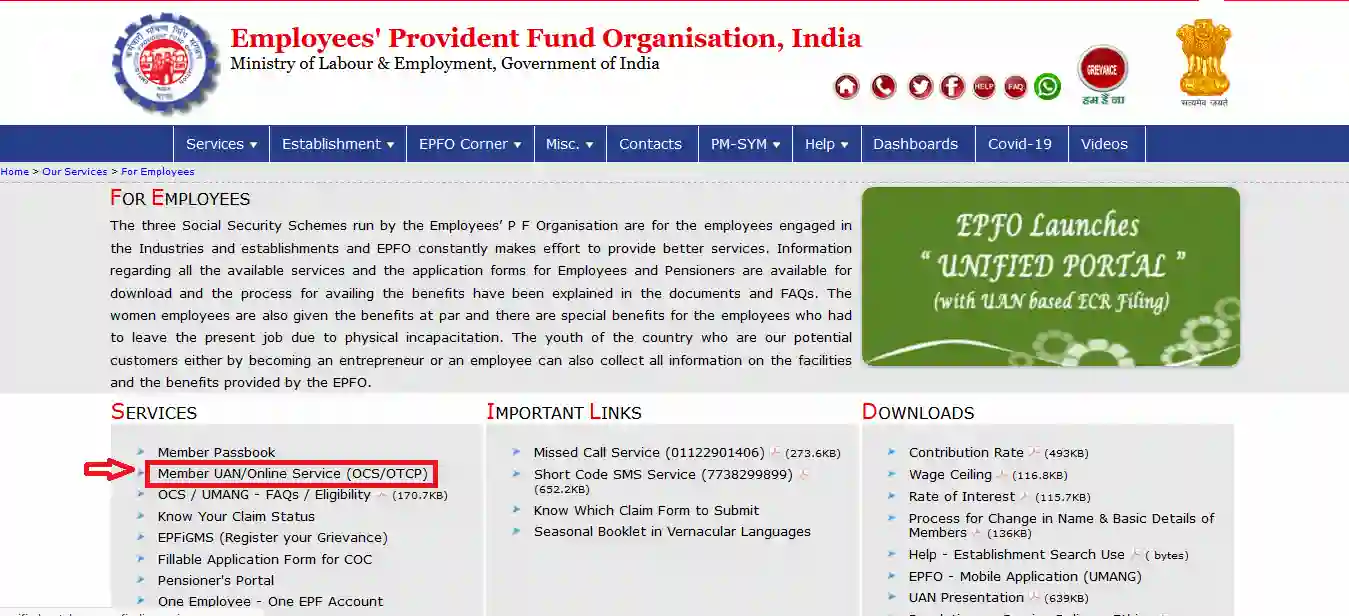

- Step 3: On the next page, the employee must click on 'Member UAN/Online Services (OCS/OTCP)' which can be found under the 'Services' section.

- Step 4: On the next page, the employee must click on 'Activate UAN'.

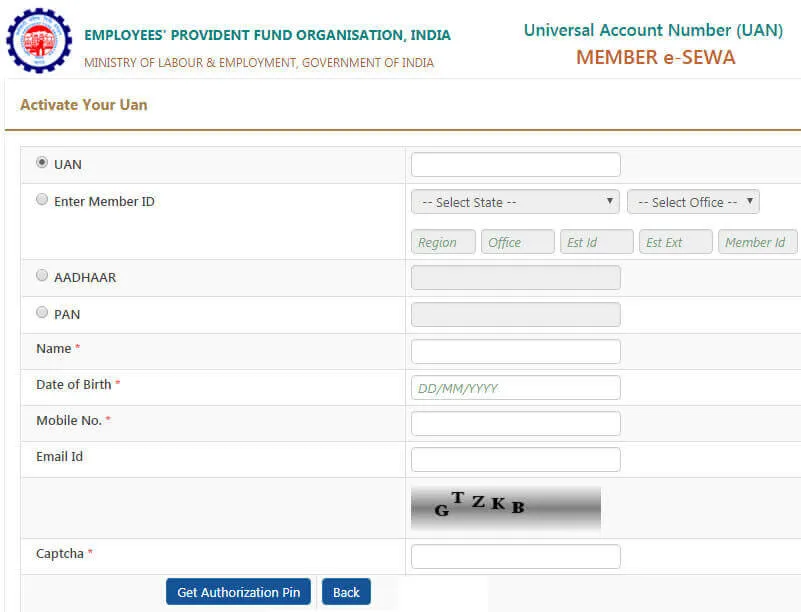

- Step 5: On the next page, individuals must enter their UAN, name, date of birth, mobile number, email ID, and captcha details. Next, individuals must click on 'Get Authorization Pin'.

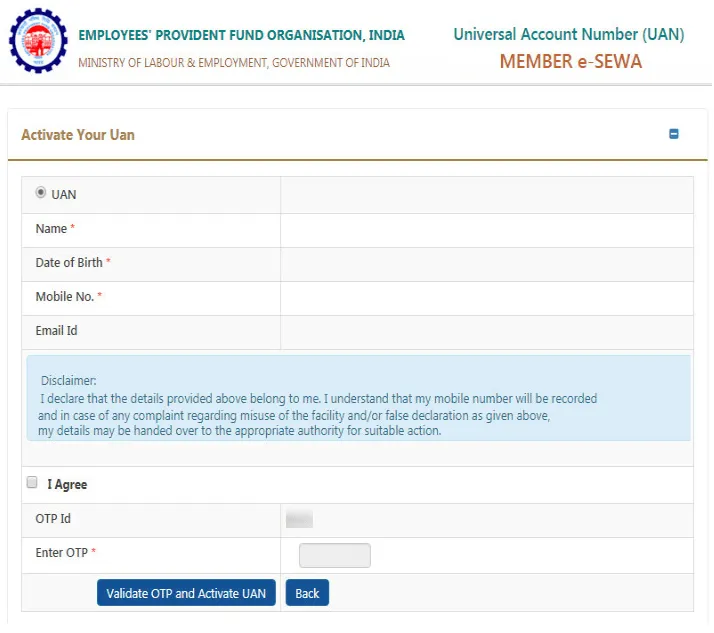

- Step 6: Individuals will receive an OTP on their mobile numbers.

- Step 7: Next, the individual must click on 'Validate OTP and Activate UAN' after entering the OTP and checking the disclaimer box.

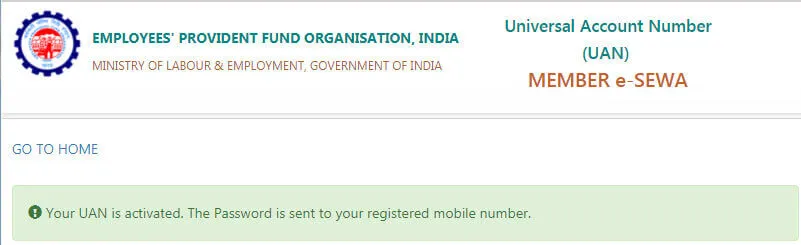

- Step 8: Individuals will receive their UAN and password on their registered mobile numbers. They will need to use these details to log in to the EPFO portal.

UAN Login

After activating the UAN, employees can log in to the EPFO portal using their UAN as username and the new password that they had created.

After logging in, the following EPF-related activities can be taken care of:

Step 1: Download the UAN card and passbook

Step 2: View PF linking status and list all member IDs

Step 3: View PF transfer claim status, file transfer claim and system generated transfer claim status

Step 4: Edit personal details including mobile number and email ID

Step 5: Update KYC information and upload KYC documents

Step 6: View helpdesk contacts

How to Download UAN Card Online

You can quickly download your UAN card if you have a valid EPF number. You must ensure that you have an active UAN and password before you log in to the EPFO portal. Here is how you can download your UAN card online:

Step 1: Visit the UAN portal and enter your UAN number and password.

Step 2: Enter the captcha code and click on ‘Sign in.’

Step 3: Choose the ‘UAN Card’ option under the ‘View’ tab.

Step 4: The card that has been linked with your account will then be displayed.

Step 5: Click on the ‘Download UAN card' option.

Step 6: Save a digital copy of your UAN card or take a printout of it.

Process to Reset UAN Password

The steps to reset your UAN password are mentioned below:

- Visit the UAN portal and click on the ‘Forgot Password’ option.

- Enter your UAN and the captcha.

- Click on the ‘Submit’ option.

- Enter your name, date of birth, and gender.

- Click on the ‘Verify’ button.

- Enter the captcha and your Aadhaar number.

- Click on the ‘Verify’ button.

- Once your entered information has been verified, enter your mobile number and click on the ‘Get OTP’ option.

- Enter the OTP and click the ‘Verify’ option.

- A password change option will now be available to you.

- Enter the password twice into the designated boxes and click on ‘Submit.’

- The EPFO portal will now be updated with the new password.

How to Delink an Incorrect Member ID from UAN?

To delink an incorrect member ID from UAN, you must follow the steps given below:

- To begin, you must go to the unified member portal and enter your CAPTCHA, password, and UAN

- You must now go to the view>> service history section

- At this point, you must click the delink button after choosing the wrong members ID

- You can now explain why you decided to delink

- Finish the verification procedure by entering the OTP that was issued to your registered mobile number

- At last, delink is completed, and a successful message appears on the screen

- After this is completed, this incorrect ID's service history won't be accessible. On the unified member site, you can confirm this once more

- Notably, the delinking process won't be finished if the employer submitted an ECR with the wrong ID. You will receive an error message in place of a success message.

Process to Obtain UAN for EPF

An employer must register with EPFO if they have 20 or more employees. The employee must inform the new employer if the UAN has already been assigned by the prior company. In the case of new hires to the organisation, the employer is required to generate the UAN -

The procedure to generate a new UAN for the employee is mentioned below:

- Visit the EPF Portal and log in to your account.

- Under the ‘Member’ section, click on the ‘Register Individual’ option.

- Enter the employee's information including Aadhaar, PAN, and bank information.

- Navigate to the ‘Approval’ section and approval all the information.

- A new UAN for the employee will be generated. The employer may link the employee's PF account to the new UAN.

Process to Complete e-KYC for EPFO

The procedure for completing the e-KYC for the EPF account is as follows:

- Enter your UAN and password to log in to the EPFO portal.

- Click on the 'KYC' option under the 'Manage' tab.

- Check the box next to the KYC document you wish to add.

- Enter the IFSC, bank account number, PAN/passport number.

- Click on the ‘Save’ option.

- The ‘KYC Pending for Approval’ section will display your KYC details.

- The EPFO will verify your information.

- You will be able to see the updated KYC under the ‘Currently Active KYC’ section.

Important Points to Keep in Mind Regarding UAN

- UAN is a lifelong account number.

- UAN facilitates the linking of a member's multiple EPF accounts.

- PAN, Aadhaar, and Bank account details of a member are the KYC documents that should be submitted for UAN linking.

- Previous EPF accounts can be clubbed through digitally authenticated KYC.

- EPF services can be accessed directly through Aadhaar enabled UAN.

- UAN is allotted by the EPFO for those members who have made at least one contribution during January 2014 or later.

- EPF members who don't have UANs and who haven't paid any contributions since January 2014 may ask the EPFO to assign them one.

- For UAN activation, a member has to register his or her mobile number with the EPFO. He or she has the option to alter the mobile number linked with UAN at a later stage.

- Any Indian citizen can request for UAN regardless of whether he or she is an EPF member or not.

- Those members who have Aadhaar enabled UAN can submit their EPF claims directly to the EPFO. Members need not approach their employers for claims attestation.

- Online applications for all UAN enabled member services are allowed.

- UAN enabled member services are useful for EPF members who tend to change their jobs and locations often.

- EPF members can download their UAN card from their online account after logging on to the Unified Portal.

- Members who already have UAN should provide their KYC and UAN to the new company when changing jobs. This will facilitate the auto-transfer of the member's previous EPF account.

Update Father Name of EPF UAN Account

If you have a UAN account, you must update your father's name under the correct name. There is no online access to the facility. The Joint Declaration Form must be submitted to the EPF service office and authorised by the employer.

The father, who is your next nominee, can withdraw the money if you are unable to do so. Your father's name on your PF account must match the name on the papers in order for the process to be completed correctly. You can immediately write to the UAN email if the employer rejects the request.

Process to Update Name and Date of Birth on the UAN Portal

If you wish to make any changes to your name and date of birth on the UAN portal, follow the procedure mentioned below:

- Visit the UAN portal and sign into your account.

- Under the ‘Manage’ tab, click on ‘Basic Details.’

- Under the section titled ‘Changes Requested,’ enter the name and date of birth you wish to modify.

- A message reading ‘Pending approval by Employer’ will appear on the screen.

- Speak with your employer and request their approval of the changes.

- After the employer’s approval, your name and date of birth will be updated by the EPFO.

Process to Update Contact Number and Email Address on the UAN Portal

Here is the procedure to update your mobile number and email address on the UAN portal:

- Visit the UAN portal and sign into your account.

- Under the ‘Manage’ tab, click on ‘Contact Details.’

- An option to change your email address or mobile number will appear.

- Click on the ‘Change Mobile Number’ or ‘Change E-mail ID’ option.

- Additional boxes will appear where you need to enter your mobile number/email address twice.

- Select the ‘Get Mobile OTP’ or ‘Get Authorization Pin’ option.

- Enter the OTP and click the ‘Submit’ button.

- The EPFO will update your new mobile number or email address on the UAN portal.

Process to Update Contact Number in UAN Portal if You Forgot the Password

In case you have forgotten your password, here is how you can update your mobile number on the UAN portal:

- Visit the UAN Portal and click on ‘Forgot Password.’

- Type in your UAN and the captcha information.

- Click on the ‘Submit’ option.

- Enter your name, gender, and date of birth.

- Click the ‘Verify’ option.

- After your entered information has been verified, enter the new mobile number linked with your Aadhaar.

- Click the ‘Get OTP’ option. Enter the OTP and click on the ‘Verify’ option.

- The option to change your password will appear on the screen.

- Type the new password twice into the designated boxes and click ‘Submit.’

- Once you submit, your new mobile number and password will be reflected on the UAN portal.

Features of UAN

Even if an employee switches employers, their UAN stays the same. Every time an employee changes or switches employment, a new Member ID will be issued to them. Under one UAN, these Member IDs will be connected. Employees can submit their UAN to new employers when they accept a new position and ask for a new Member ID.

Mentioned below are the main features of the UAN:

- The introduction of the UAN helps in keeping track of the number of times an employee has changed jobs.

- The EPFO was allowed to have access to bank and Know Your Customer (KYC) details of an employee only after UAN was introduced.

- The introduction of the UAN has helped reduce the number of early withdrawals from the EPF scheme.

- The introduction of the UAN helps in reducing the trouble that companies and organisations go through in the verification of employees.

- UAN aids in the centralisation of employee data.

- Through UAN, you can access many PF e-services including downloading the UAN card, viewing and downloading the PF passbook, updating KYC and basic details, tracking EPF claim status, etc.

Documents required for UAN

The documents required for obtaining a UAN are mentioned below:

- Bank details such as branch name, IFSC code, and account number must be submitted.

- Proof of identity such as Aadhaar Card, Voter ID, Passport, Driving License, etc., must be submitted.

- Any address proof with the member's current address mentioned on it must be submitted.

- Permanent Account Number (PAN) Card.

- Aadhaar Card must be submitted. The submission of Aadhaar Card is mandatory as it is linked to the member's mobile number and bank account.

- Employees' State Insurance Corporation (ESIC) Card.

Benefits of UAN

Given below are the advantages of the UAN:

- It is very easy for members to download the EPF statement. They can either use the EPFO portal or send an SMS to avail this facility.

- Employers will not be able to withhold the EPF money of the employees due to the presence of the UAN. Employees can check on a regular basis whether the employer has contributed its share of the money towards EPF.

- All Member IDs of the employee come under one UAN. Therefore, it is easy to access all the Member IDs.

- Transfer EPF amount from the old Member ID to the current one can be easily done online with the help of the UAN.

- Your profile doesn't need to be verified by new employers if your UAN has already been Aadhaar and KYC-verified.

- With the UAN, it is simpler to make partial or full PF withdrawals.

Facilities of EPFO

Presently, members are entitled to the following facilities:

- UAN Card can be download

- Passbook can be downloaded

- Previous Member IDs can be viewed

- KYC details can be entered

- Personal details can be edited

- Eligibility for online transfer claim can be checked

How to Link Aadhaar with UAN Online

Subscribers can now link their Aadhaar number with their UAN via the EPFO website "epfindia.gov.in". This facility, which has been made available since Diwali eve 2017, has been introduced with the aim of boosting volume of online claims, and eventually going paperless.

The steps to link Aadhaar with UAN are as follows:

Step 1: Visit the EPFO portal and log in to your account.

Step 2: Under the ‘For Employees’ section, click the ‘UAN Member e-Sewa’ option.

Step 3: Sign into the portal by entering your UAN, password, and captcha.

Step 4: Select 'KYC' from the 'Manage' tab in the top panel.

Step 5: Tick the Aadhaar check box and enter your Aadhaar number.

Step 6: Save the information.

Step 7: Your information will appear under the 'Pending KYC' tab after you have submitted it.

Step 8: Upon approval by the employer, the Aadhaar-UAN linking will be displayed under the 'Approved KYC' section. The approval typically takes 15 days.

The procedure to link Aadhaar with UAN is as follows:

- Visit the EPFO portal and log in to your account.

- Under the ‘For Employees’ section, click the ‘UAN Member e-Sewa’ option.

- Sign into the portal by entering your UAN, password, and captcha.

- Select 'KYC' from the 'Manage' tab in the top panel.

- Tick the Aadhaar check box and enter your Aadhaar number.

- Save the information.

- Your information will appear under the 'Pending KYC' tab after you have submitted it.

- Upon approval by the employer, the Aadhaar-UAN linking will be displayed under the 'Approved KYC' section. The approval typically takes 15 days.

You can also visit the nearest EPFO office and submit the necessary details to link the Aadhaar with the UAN.

Linking your Aadhaar to your EPF account will speed up the withdrawal and transfer process. The employee's Aadhaar details should be approved and verified by the current employer.

Link Multiple EPF Accounts

The process that must be followed to link multiple EPF accounts to one UAN is mentioned below:

- Visit https://www.epfindia.gov.in/site_en/For_Employees.php.

- Click on ‘One Employee – One EPF Account’.

- Enter the relevant details on the next page.

- Enter the OTP that is sent to the registered mobile number.

- Enter the old EPF ID next to complete the process.

UAN Customer Care Number

In case of any queries or issues with your UAN, you can reach out to the EPFO in the following ways:

- UAN toll-free number: 1800-118-005

- UAN Helpdesk Email ID: employeefeedback@epfindia.gov.in

- Timing - 9:15 a.m. to 5:45 p.m.

FAQs on UAN

- What is a UAN card and what information does it contain?

The UAN card has an employee's UAN number. The front side of the card displays a photo and KYC (in case the KYC documents are verified by the employer). The backside of the card has the latest five-member IDs along with contact details of the EPF helpdesk.

- What is the login password to the UAN portal?

The member will have to create a password during his/her activation of UAN. The password must be 8-25 characters long, have a special character, and must be alphanumeric.

- What happens to an employee's UAN in case of a job change?

The employee only has to supply the UAN when joining a new organisation if the UAN has already been assigned to him or her; the new employer will then link the new member ID to the employee's UAN. Throughout a person's career, their UAN doesn't change.

- How can I find out my UAN number without my mobile number?

Your employer is where you can obtain your UAN. To obtain your UAN without a mobile number, you must speak with your HR/accounts department. The UAN is also displayed on the pay slips in some organisations.

- How to transfer the balance from old EPF accounts and link it with the UAN?

After an employee's new EPF account is linked to his or her UAN, the balance can be transferred from the previous/old EPF accounts. The transfer can be done online. The status of the transfer can also be checked online.

- What to do if an employee has been allotted two UANs? How to get a UAN validated?

Employees may occasionally be given two UANs for a variety of reasons while providing their UAN to both their present and prior employers. If that occurs, the employee must immediately get in touch with the EPF service line and specify both UANs. After proper verification, the prior UAN will be blocked and the current UAN will be activated.

- What to do if an employee's date of birth has not been mentioned correctly on the EPF card?

In case an employee has to change their date of birth, father's name, or they can apply for the same with supporting documents through their organisation. Contact the EPF helpdesk for more information regarding the change of personal details in the UAN card.

- How can I find out the UAN number from a missed call?

You can get the UAN number via a missed call if you are signed up and have activated your UAN on the UAN portal. From their registered mobile phone, members can make a missed call to 9966044425.

- How to include photograph on the UAN Card?

Photographs on the UAN Card are not available now. The facility will be available on successful seeding of KYC of Aadhaar. Currently, the process is ongoing.

- Can a scanned KYC document be uploaded?

A scanned document with a maximum size of 300 KB can be uploaded. Up to 8 scanned documents can be uploaded.

- Whom can employees contact for any queries regarding the UAN portal?

For any queries regarding the UAN portal, call the toll-free helpdesk number - 18001-18005.

- Why is member activation required for the completion of the auto-transfer process?

Ensuring members are updated on the status of their transactions via their registered mobile number is the main idea for linking activation and EPFO services.

- How long will EPF take to make changes in personal particulars?

Once the employer sends the complete information to the respective field office, it will take 1 month for the changes to be uploaded. The changes will be as per EPF norms.

- Why is it necessary to link Aadhaar Card with UAN?

For EPF claims to be resolved expeditiously, the EPFO has implemented a number of initiatives. The Aadhaar Card must be linked to the UAN in order for claims to be resolved quickly. In order to submit claims for partial withdrawals for medical, educational, or marriage purposes without obtaining an attestation from the employer or providing any supporting documentation to the EPFO, it may be helpful to link your Aadhaar card to your UAN.

- Can employers withhold EPF balance when an employee changes jobs?

No, this is not possible because the UAN, which is transferable among all eligible employers, is linked to the balance in EPF accounts.

News on UAN

EPFO Reminder: Mandatory Aadhaar-UAN Seeding Required for Smooth ECR Submission

According to a circular dated 1 December 2025, the EPFO has cancelled the extension of the deadline for Aadhaar linkage with UAN in order to file ECR before the end of October. Starting in November 2025, ECR filing will only be accessible to members whose Aadhaar numbers have been issued and verified with UAN.

New EPFO Update: Aadhaar-Based Facial Recognition Now Essential for UAN Creation

According to the Employees Provident Fund Organization (EPFO), the UMANG App's Aadhaar-based Face Authentication Technology (FAT) will be the only method used for Universal Account Number (UAN) production and allocation. The new regulation became effective on 1 August 2025. In some cases, such as for foreign employees and citizens of Nepal and Bhutan, the current procedure for creating a UAN through the employer will still be in effect. Three EPFO capabilities for members and employees were added to the UMANG app using Face Authentication Technology, according to an earlier circular from 8 April 2025, which was mentioned in the circular on 30 July 2025.

Disclaimer

Credit Card:

Credit Score:

Personal Loan:

Home Loan:

Fixed Deposit:

Copyright © 2026 BankBazaar.com.